Trading often tempts us to follow the herd – buying when everyone else is buying, and selling in a frenzy of fear. But savvy traders understand the potential hidden in contrarian strategies. Indicators like IG client sentiment offer a unique window into the market’s collective mood, revealing instances where overwhelming optimism or pessimism can signal a potential reversal.

Of course, contrarian signals aren’t a crystal ball. They shine brightest when used to enrich an already robust trading strategy. By combining contrarian insights with careful technical and fundamental analysis, traders gain a richer understanding of the forces driving the market – forces that the crowd might easily overlook. Let’s explore this concept by examining IG client sentiment and its potential impact on the euro across four key FX pairs: EUR/USD, EUR/CHF, EUR/GBP, and EUR/JPY.

IG data reveals a slight but fading bullish bias towards the EUR/USD among retail traders. Currently, 53.15% of clients hold net-long positions, resulting in a long-to-short ratio of 1.13 to 1. This positive tilt has weakened significantly, with net-long positions down a substantial 10.90% compared to yesterday, despite a tiny 0.05% increase over the week. Mirroring this, net-short positions surged by 31.26% since yesterday and are up 11.10% over the week.

Typically, a net-long stance hints at potential declines from a contrarian perspective. But, the recent shift in sentiment complicates the outlook. While a slight majority still favors the upside, the growing number of traders leaning bearish could signal an impending bullish burst for EUR/USD.

All in all, EUR/USD presents a mixed picture. It’s essential for traders to proceed with caution and not rely solely on sentiment. These insights should be combined with thorough technical and fundamental analysis for a well-informed trading strategy.

EUR/CHF FORECAST – MARKET SENTIMENT

Data from IG reveals clients are bullish on EUR/CHF, with 53.08% of traders currently holding net-long positions. This results in a long-to-short ratio of 1.13 to 1. However, sentiment appears to be weakening, with net-long positions down 3.10% since yesterday, even while they’ve increased by 8.70% compared to last week. Mirroring this, net-short positions are up 12.18% from yesterday but down 6.75% compared to last week.

Our typical contrarian approach suggests EUR/CHR could be in for a pullback. However, the recent weakening of buying positions on the pair and the mixed timeframe comparisons create a less confident outlook.

Overall, the EUR/CHF presents a complex picture based on current sentiment. While there may be some downward pressure, the lack of a strong contrarian signal warrants caution. As always, traders should consider these clues within a broader technical and fundamental analysis framework before making any trading decisions.

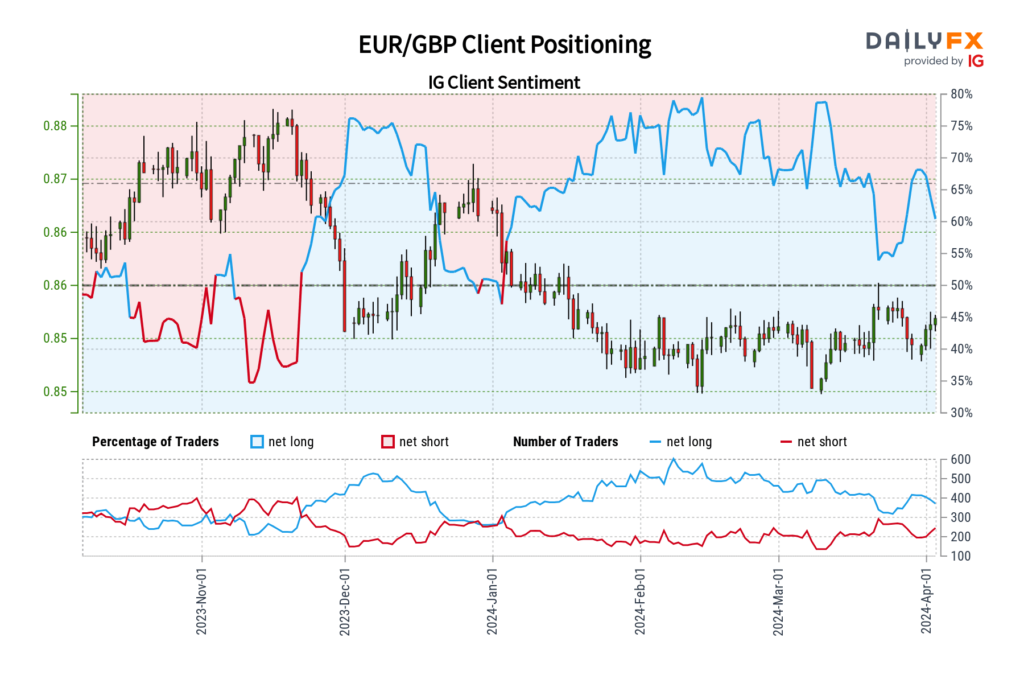

EUR/GBP FORECAST – MARKET SENTIMENT

Based on IG data, the sentiment surrounding EUR/GBP within the retail crowd appears optimistic, with 61.22% of traders maintaining net-long positions. This equates to a long-to-short ratio of 1.58 to 1. Nevertheless, this bullish stance is beginning to wane, as net-longs have declined by 1.80% since yesterday, despite a 4.95% jump over the past week. In contrast, net-shorts experienced a large 9.01% surge from yesterday but demonstrate a more consistent decrease of 12.00% versus last week’s levels.

Traditionally, substantial net-long positioning might indicate potential losses for the underlying asset from a contrarian standpoint. However, recent shifts in market positioning have clouded the clarity of this signal. Presently, EUR/GBP appears to be caught amidst conflicting forces. While contrarian indicators still suggest some downward pressure is probable, the absence of a robust, enduring trend renders it a less assured prediction.

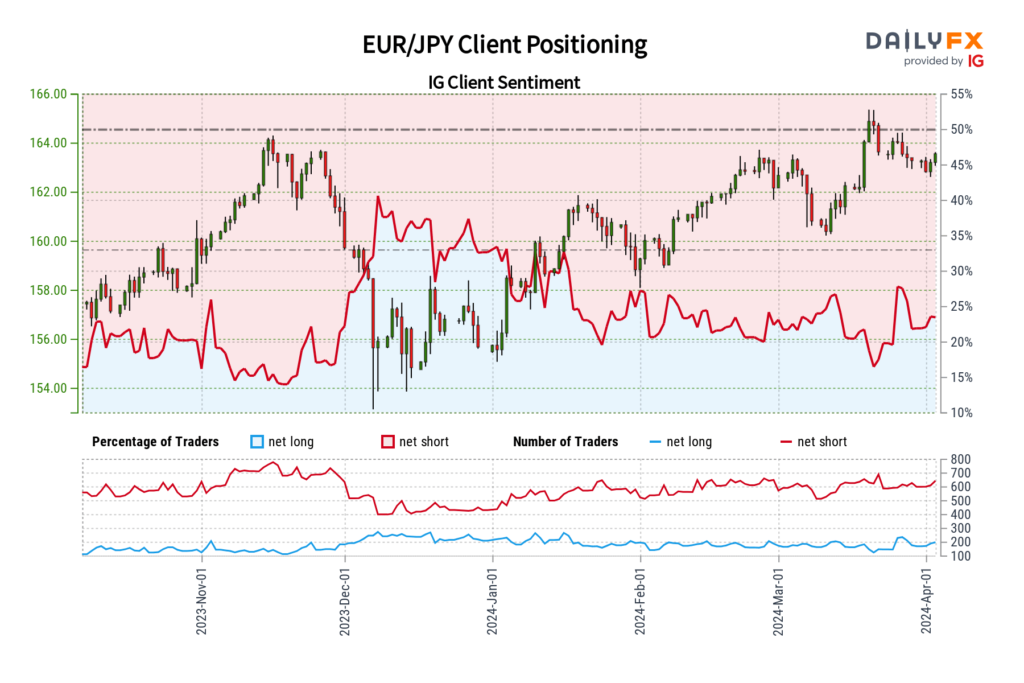

EUR/JPY FORECAST – MARKET SENTIMENT

IG data reveals a strong bearish bias towards the EUR/JPY, with 73.47% of traders currently holding net-short positions. This translates to a significant 2.77 to 1 short-to-long ratio. Notably, the number of net-short positions has climbed by 7.11% since yesterday and 1.73% compared to last week. However, net-long positions have also surged, up 25.13% from yesterday and a notable 18.78% from last week.

Our contrarian approach suggests this heavy net-short positioning could be a positive sign for the EUR/JPY. Yet, the recent weakening of the bearish bias introduces a degree of uncertainty. While the contrarian perspective still points to potential gains for the pair, the increasing number of long positions over key timeframes warns that a trend shift may be imminent.

As always, traders should carefully integrate sentiment signals with a well-rounded strategy that includes thorough technical and fundamental analysis.