Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

RELATED ARTICLES

Euro Forecast and Sentiment Analysis: EUR/USD, EUR/CHF, EUR/GBP, EUR/JPY

Trading often tempts us to follow the herd – buying when everyone else is buying, and selling in a frenzy of fear. But savvy traders understand the potential hidden in contrarian strategies. Indicators like IG client sentiment offer a unique window into the market’s collective mood, revealing instances where overwhelming optimism or pessimism can signal […]

Trading often tempts us to follow the herd – buying when everyone else is buying, and selling in a frenzy of fear. But savvy traders understand the potential hidden in contrarian strategies. Indicators like IG client sentiment offer a unique window into the market's collective mood, revealing instances where overwhelming optimism or pessimism can signal a potential reversal.

Of course, contrarian signals aren't a crystal ball. They shine brightest when used to enrich an already robust trading strategy. By combining contrarian insights with careful technical and fundamental analysis, traders gain a richer understanding of the forces driving the market – forces that the crowd might easily overlook. Let's explore this concept by examining IG client sentiment and its potential impact on the euro across four key FX pairs: EUR/USD, EUR/CHF, EUR/GBP, and EUR/JPY.

IG data reveals a slight but fading bullish bias towards the EUR/USD among retail traders. Currently, 53.15% of clients hold net-long positions, resulting in a long-to-short ratio of 1.13 to 1. This positive tilt has weakened significantly, with net-long positions down a substantial 10.90% compared to yesterday, despite a tiny 0.05% increase over the week. Mirroring this, net-short positions surged by 31.26% since yesterday and are up 11.10% over the week.

Typically, a net-long stance hints at potential declines from a contrarian perspective. But, the recent shift in sentiment complicates the outlook. While a slight majority still favors the upside, the growing number of traders leaning bearish could signal an impending bullish burst for EUR/USD.

All in all, EUR/USD presents a mixed picture. It's essential for traders to proceed with caution and not rely solely on sentiment. These insights should be combined with thorough technical and fundamental analysis for a well-informed trading strategy.

EUR/CHF FORECAST – MARKET SENTIMENT

Data from IG reveals clients are bullish on EUR/CHF, with 53.08% of traders currently holding net-long positions. This results in a long-to-short ratio of 1.13 to 1. However, sentiment appears to be weakening, with net-long positions down 3.10% since yesterday, even while they've increased by 8.70% compared to last week. Mirroring this, net-short positions are up 12.18% from yesterday but down 6.75% compared to last week.

Our typical contrarian approach suggests EUR/CHR could be in for a pullback. However, the recent weakening of buying positions on the pair and the mixed timeframe comparisons create a less confident outlook.

Overall, the EUR/CHF presents a complex picture based on current sentiment. While there may be some downward pressure, the lack of a strong contrarian signal warrants caution. As always, traders should consider these clues within a broader technical and fundamental analysis framework before making any trading decisions.

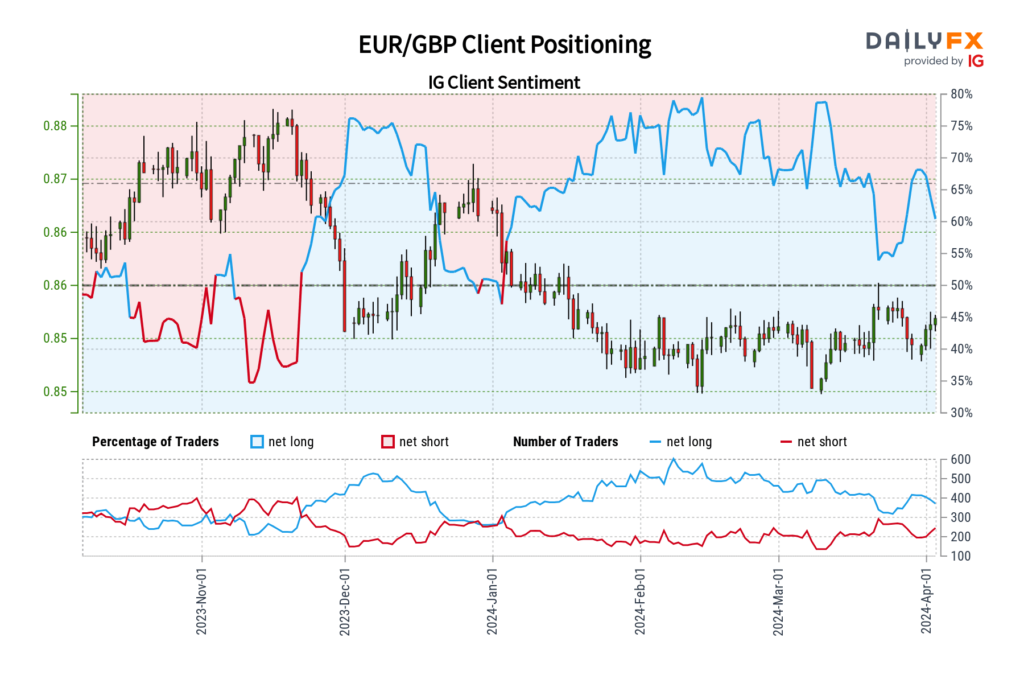

EUR/GBP FORECAST – MARKET SENTIMENT

Based on IG data, the sentiment surrounding EUR/GBP within the retail crowd appears optimistic, with 61.22% of traders maintaining net-long positions. This equates to a long-to-short ratio of 1.58 to 1. Nevertheless, this bullish stance is beginning to wane, as net-longs have declined by 1.80% since yesterday, despite a 4.95% jump over the past week. In contrast, net-shorts experienced a large 9.01% surge from yesterday but demonstrate a more consistent decrease of 12.00% versus last week’s levels.

Traditionally, substantial net-long positioning might indicate potential losses for the underlying asset from a contrarian standpoint. However, recent shifts in market positioning have clouded the clarity of this signal. Presently, EUR/GBP appears to be caught amidst conflicting forces. While contrarian indicators still suggest some downward pressure is probable, the absence of a robust, enduring trend renders it a less assured prediction.

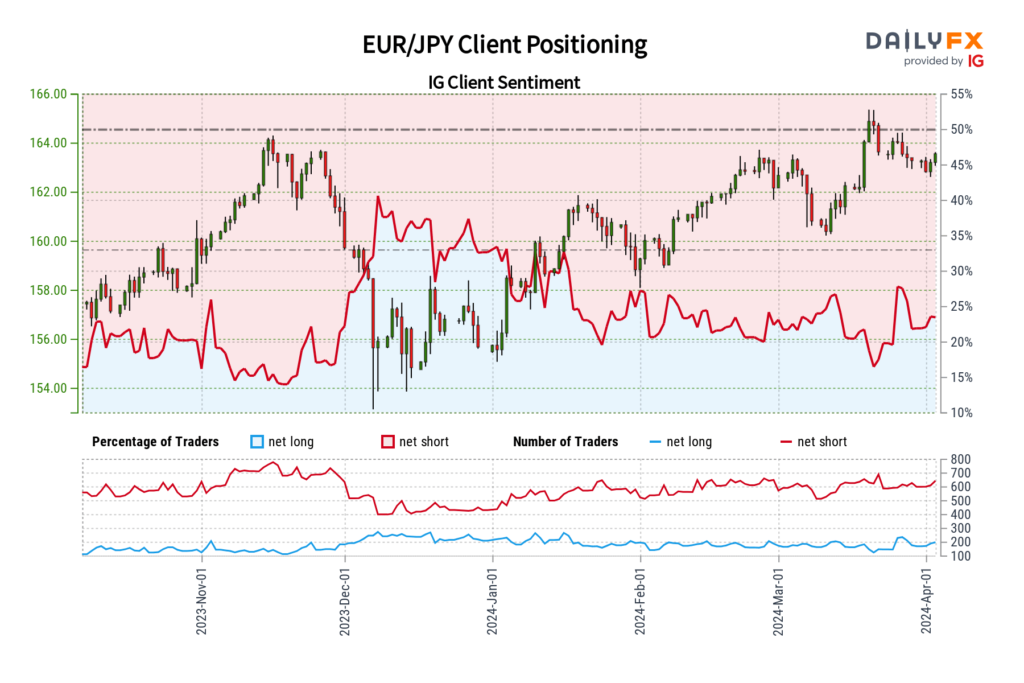

EUR/JPY FORECAST – MARKET SENTIMENT

IG data reveals a strong bearish bias towards the EUR/JPY, with 73.47% of traders currently holding net-short positions. This translates to a significant 2.77 to 1 short-to-long ratio. Notably, the number of net-short positions has climbed by 7.11% since yesterday and 1.73% compared to last week. However, net-long positions have also surged, up 25.13% from yesterday and a notable 18.78% from last week.

Our contrarian approach suggests this heavy net-short positioning could be a positive sign for the EUR/JPY. Yet, the recent weakening of the bearish bias introduces a degree of uncertainty. While the contrarian perspective still points to potential gains for the pair, the increasing number of long positions over key timeframes warns that a trend shift may be imminent.

As always, traders should carefully integrate sentiment signals with a well-rounded strategy that includes thorough technical and fundamental analysis.

USD/JPY forecast: BOJ intervention risk, geopolitics cap upside despite US inflation threat

The overview USD/JPY sits in a narrow trading range, sandwiched by bullish fundamentals and threat of intervention from the Bank of Japan to support the yen. The latter has reduced the odds of near-term upside for USD/JPY despite the release of important inflation updates in the United States this week. Unless the Japanese government softens […]

- USD/JPY continued to sideways range trade, with bullish fundamentals offset by the threat of BOJ intervention

- US CPI and PPI reports, the ECB interest rate decision and geopolitics loom as the key drivers for USD/JPY this week

- Near-term bias remains to sell rallies in USD/JPY rather than buying dips

The overview

USD/JPY sits in a narrow trading range, sandwiched by bullish fundamentals and threat of intervention from the Bank of Japan to support the yen. The latter has reduced the odds of near-term upside for USD/JPY despite the release of important inflation updates in the United States this week.

Unless the Japanese government softens its public stance towards weakness in the yen, the preference is to sell rallies rather than buy dips or breaks. Geopolitical tensions in the Middle East are another wildcard for traders to navigate.

Key events for USD/JPY

There’s no need to reinvent the wheel when it comes to the likely USD/JPY drivers this week with the US interest rate outlook and geopolitics the key areas to focus on. As the latter is impossible to predict, what we as traders can do is look at the events that are likely to have the largest impact, taking into consideration positioning and technical factors.

Over the week, three such events stand out: the US consumer price inflation report on Wednesday, the US Producer price inflation report on Thursday and the ECB interest rate decision, also on Thursday. While the Fed speaking calendar is extremely busy, they key point to remember is the tone will be heavily influenced by these events, along with last Friday’s blockbuster US non-farm payrolls report.

There’ll be plenty of headlines to navigate, including from the FOMC minutes on Wednesday, but the vast majority will be noise and not impact USD/JPY meaningfully.

US CPI preview

Having topped market expectations at the headline and underlying level in the first two months of the year, markets may receive greater clarity as to whether the inflation acceleration is the start of a new trend or simply a seasonal anomaly.

Both headline and core CPI are forecast to lift 0.3%, down a tenth from February. While a deceleration, both would be incompatible with inflation returning to the Fed’s 2% inflation mandate in a timely manner.

The core services ex-housing figure, known simply as “supercore” inflation, will be influential given the Fed has nominated it as something it’s watching. It decelerated noticeably in February, minimising the damage to the dovish rates case despite the heat in other readings.

Potential USD/JPY market reactions

If that happens and we see no upside surprise in the core or headline inflation rates, it’s likely US front-end bond yields will decline, dragging back-end rates lower with it. That should narrow the yield differential between the US and Japan and weigh on USD/JPY. However, if we see another upside surprise, especially at the core level, USD/JPY and yields would likely lift, reflecting the diminishing case for Fed rate cuts in 2024.

Source: Refinitiv

US PPI, ECB rates decision in focus

The same approach applies for Thursday’s producer price inflation report with a hotter reading likely to lift USD/JPY, and vice versus if cold. A 0.3% gain is expected.

The ECB monetary policy meeting is the other key event simply because the euro is the largest weight in the US dollar index, making its fluctuations influential on other G10 FX names, including the yen. While no change in policy rates is expected, there is a growing risk it may signal the likely timing of its first rate cut will be brought forward from June. If that eventuates, EUR would likely weaken against the USD, dragging JPY along with it.

As for geopolitics, the rule of thumb is that if the tensions in the Middle East are subsiding, it should boost USD/JPY. If they escalate significantly, the likely repatriation of capital to Japan would weigh heavily on USD/JPY.

USD/JPY technical setup

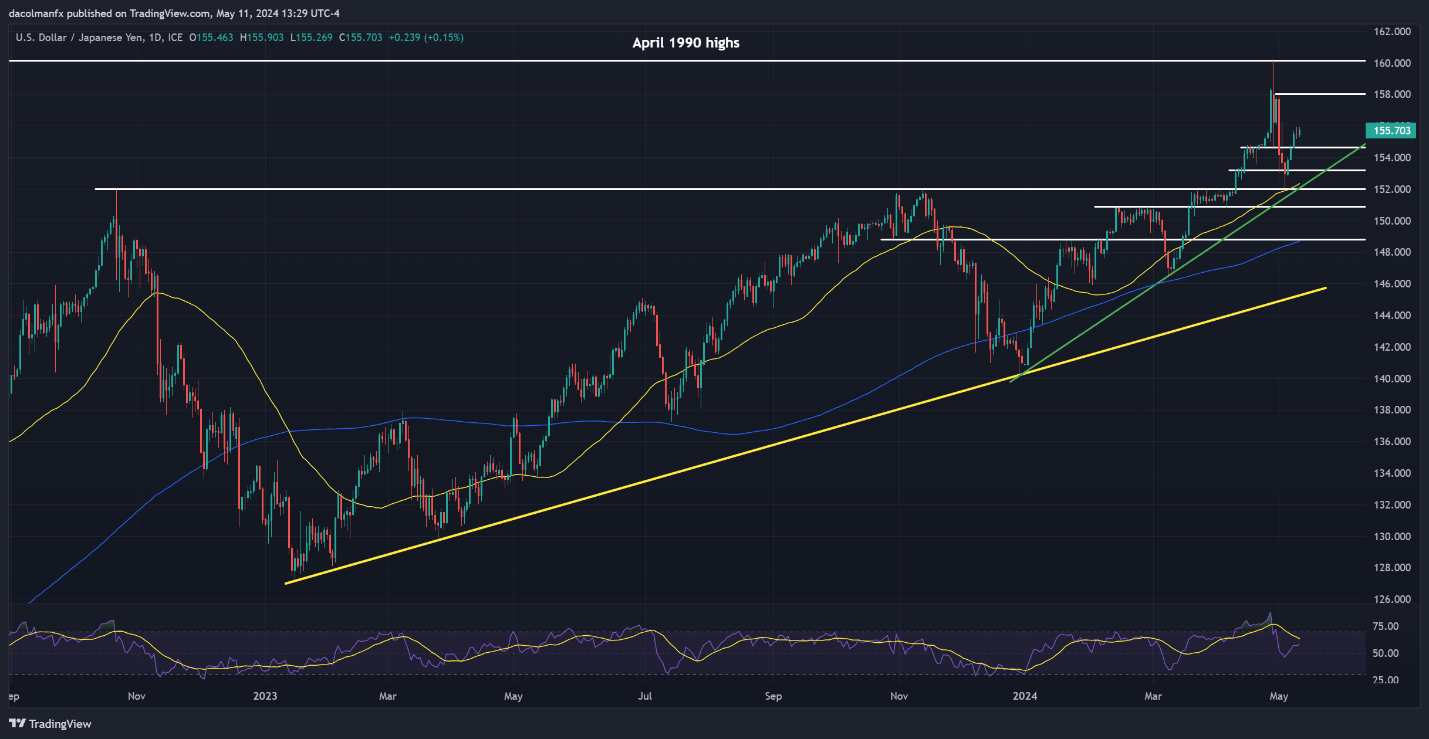

With markets continued to pare rate cut expectations from the Fed, widening interest rate differentials with Japan, fundamentals suggest the bias for USD/JPY should be higher heading into the US inflation reports this week. However, with the threat of intervention from the BOJ elevated, rallies continue to suffocate on pushes towards resistance at 152, creating what I’ve described previously as a stalemate scenario.

With USD/JPY sandwiched by the intervention threat and bullish fundamentals, I’ll direct you to recent trade ideas that remain valid and have already worked since written. They can be accessed here and here.

The one overriding message is that while the technical picture looks bullish for USD/JPY, with a break of 152 pointing to the potential for substantial gains, the threat of BOJ intervention has greatly reduced the odds we’ll see significant upside should a topside break occur.

That suggests there’s limited reward and ample risk of going long on pushes toward 152. If the BOJ were to intervene, or even just signal such a move was imminent, USD/JPY could fall hundreds of pips in the space of seconds. As such, unless the Japanese government’s stance towards the weaker yen shifts substantially, selling rallies, rather than buying dips or breaks, remains the preferred strategy.

Resistance is located just below 152 with support located at 151.50, 151.20, 150.80 and 150.27. A more pronounced support zone is located between 149.58 and 149.00. Good luck!

-- Written by David Scutt

Follow David on Twitter @scutty

Via Forex.com

US Dollar’s Path Tied to Inflation Outlook; Setups on EUR/USD, USD/JPY, GBP/USD

After a subdued performance earlier this month, the U.S. dollar (DXY index) advanced this past week, climbing roughly 0.23% to 105.31. This resurgence was buoyed by a slight uptick in U.S. Treasury yields and a prevailing sense of caution among traders as they await the release of April’s U.S. consumer price index (CPI) figures, scheduled for this Wednesday. The […]

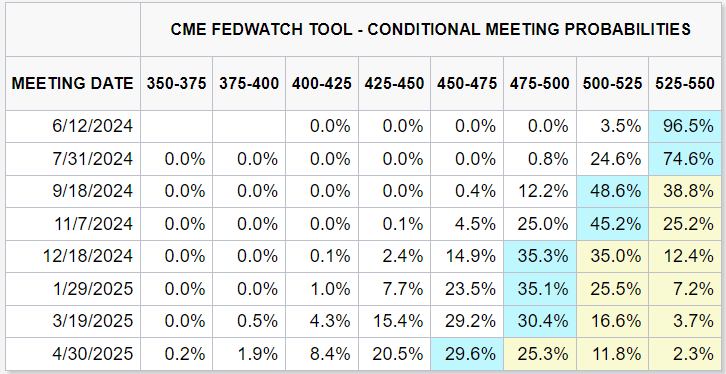

After a subdued performance earlier this month, the U.S. dollar (DXY index) advanced this past week, climbing roughly 0.23% to 105.31. This resurgence was buoyed by a slight uptick in U.S. Treasury yields and a prevailing sense of caution among traders as they await the release of April's U.S. consumer price index (CPI) figures, scheduled for this Wednesday. The greenback could build upon its recent rebound if the pattern of consistently hotter-than-expected and sticky inflation readings observed this year repeats itself in next week's fresh cost of living data from the Bureau of Labor Statistics. Consensus forecasts indicate that both headline and core CPI registered a 0.3% uptick on a seasonally adjusted basis last month, resulting in the annual readings shifting from 3.5% to 3.4% for the former and from 3.8% to 3.7% for the latter—a modest yet encouraging step in the right direction.

FOMC MEETING PROBABILITIES

Source: CME Group

In the event of another upside surprise in the data, we could see yields rise across the board on the assumption that the Fed could delay the start of its easing campaign until much later in the year or 2025. Higher interest rates for longer in the U.S., just as other central banks prepare to start cutting them, should be a tailwind for the U.S. dollar in the near term.

Want to stay ahead of the EUR/USD’s next major move? Access our quarterly forecast for comprehensive insights. Request your complimentary guide now to stay informed on market trends!

Source: CME Group

In the event of another upside surprise in the data, we could see yields rise across the board on the assumption that the Fed could delay the start of its easing campaign until much later in the year or 2025. Higher interest rates for longer in the U.S., just as other central banks prepare to start cutting them, should be a tailwind for the U.S. dollar in the near term.

Want to stay ahead of the EUR/USD’s next major move? Access our quarterly forecast for comprehensive insights. Request your complimentary guide now to stay informed on market trends!

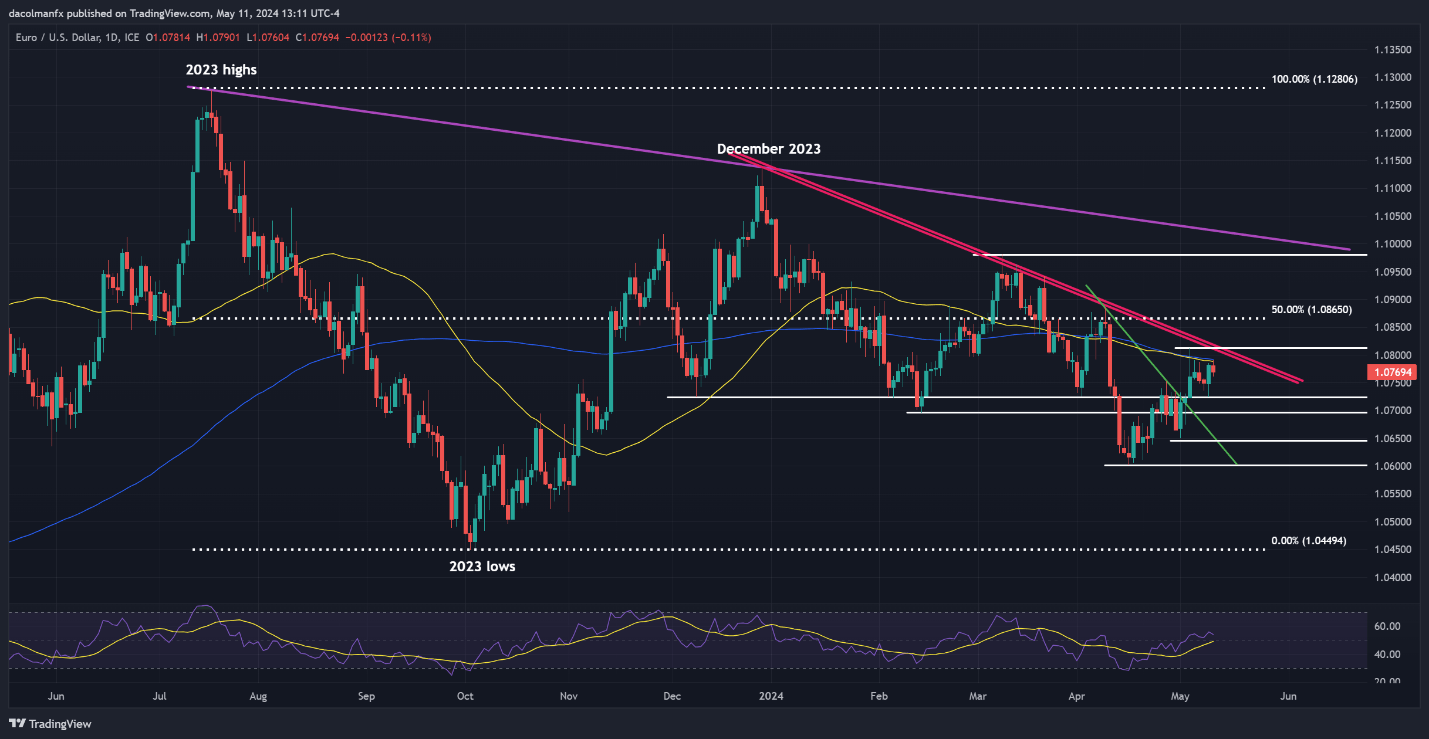

EUR/USD FORECAST - TECHNICAL ANALYSIS

EUR/USD rose modestly this past week, but so far has been unable to break above its 50-day and 200-day simple moving averages at 1.0790, a solid technical barrier. Bears will have to continue to defend this ceiling firmly; failure to do so could result in a rally toward trendline resistance at 1.0810. On further strength, the spotlight will turn to 1.0865, the 50% Fibonacci retracement of the 2023 decline. In the scenario of price rejection from current levels and subsequent downward shift, support areas can be identified at 1.0725, followed by 1.0695. On a pullback, the pair could find stability around this floor before initiating a turnaround, but should a breakdown occur, we could see a rapid drop towards 1.0645, with the possibility of a bearish continuation towards 1.0600 if selling momentum intensifies.EUR/USD PRICE ACTION CHART

EUR/USD Chart Created Using TradingView

Pondering the role of retail positioning in shaping USD/JPY’s near-term path? Our sentiment guide offers indispensable insights. Don't wait—claim your guide today!

EUR/USD Chart Created Using TradingView

Pondering the role of retail positioning in shaping USD/JPY’s near-term path? Our sentiment guide offers indispensable insights. Don't wait—claim your guide today!

| CHANGE IN | LONGS | SHORTS | OI |

| DAILY | -6% | 0% | -2% |

| WEEKLY | -11% | 12% | 5% |

USD/JPY FORECAST - TECHNICAL ANALYSIS

USD/JPY regained strength and climbed past 155.50 this past week. If we see a follow-through to the upside in the days ahead, resistance awaits at 158.00 and 160.00 thereafter. Any rally towards these levels should be viewed with caution, given the risk of FX intervention by Japanese authorities to support the yen, which has the potential to trigger a sharp and abrupt downward reversal if repeated again. On the flip side, if sellers mount a comeback and prices begin to head south, initial support materializes at 154.65, followed by 153.15. Further losses below this threshold could boost selling interest, paving the way for a move towards trendline support and the 50-day simple moving average positioned slightly above the 152.00 handle.USD/JPY PRICE ACTION CHART

USD/JPY Chart Created Using TradingView

For an extensive analysis of the British pound’s medium-term prospects, download our Q2 trading forecast now!

USD/JPY Chart Created Using TradingView

For an extensive analysis of the British pound’s medium-term prospects, download our Q2 trading forecast now!

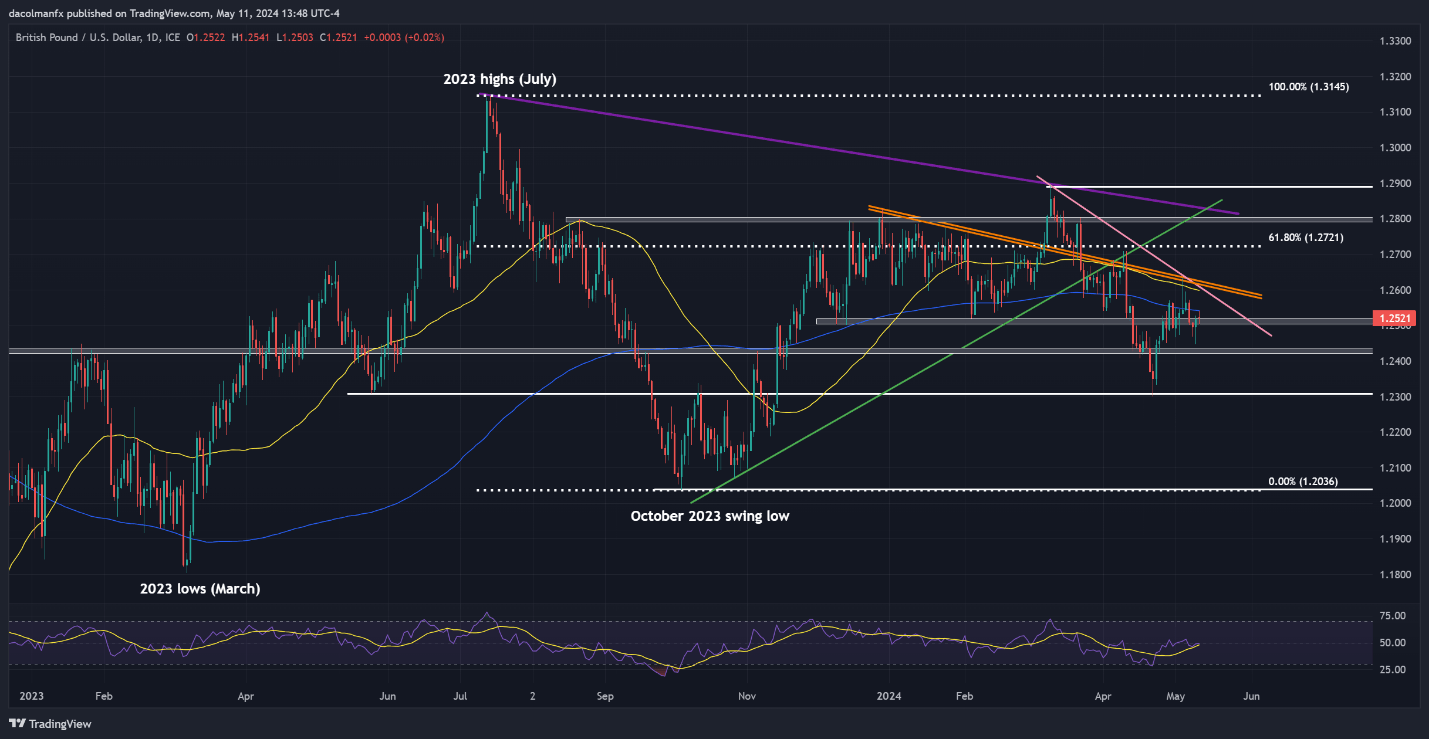

GBP/USD FORECAST - TECHNICAL ANALYSIS

GBP/USD declined slightly this past week, but managed to hold above support at 1.2500. To thwart a drop of greater magnitude, bulls must resolutely protect this technical floor; any lapse in defense could quickly precipitate a plunge towards 1.2430. Additional downside progression from this point onward could lead to a retreat towards the April lows at 1.2300. Conversely, if buyers step in and drive prices above the 200-day SMA, confluence resistance extends from 1.2600 and 1.2630 – an area that marks the convergence of the 50-day simple moving average with two prominent trendlines. Surmounting this barrier might pose a challenge for bulls, but a breakout could usher in a move towards 1.2720, the 61.8% Fib retracement of the July/October 2023 downturn.GBP/USD PRICE ACTION CHART

GBP/USD Chart Created Using TradingView

GBP/USD Chart Created Using TradingView

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.