What Drives The Forex Market

Carry, what is it and what does it Do? “Carry” refers to the difference in interest rates between the two currencies in a currencypair, and is one of the major drivers in the foreign exchange market. Carry can be likened to adividend, paid by a stock, but with two key differences. First, carry is paid […]

Carry, what is it and what does it Do?

“Carry” refers to the difference in interest rates between the two currencies in a currency

pair, and is one of the major drivers in the foreign exchange market. Carry can be likened to a

dividend, paid by a stock, but with two key differences. First, carry is paid daily, and second,

carry can be negative – which means carry can actually cost you money, as well as make you

money. Currently (and usually) commodity currencies like AUD and NZD have the highest

interest rates, while funding currencies, like USD and JPY have the lowest. Therefore, buying

AUD against USD and JPY yields a trader a positive carry, whereas selling AUD using USD and

JPY yields a negative carry.

Why do we Care about Carry?

There are three major reasons why traders should care about carry. The first is that it adds

up. While the amount of money added or subtracted from your account is generally small,

holding a position with negative carry for a long period of time will eat into your profits, and

must be taken into account when determining your trading plan.

The second reason traders care about carry is because carry helps determine the overall

direction of the market. There are cases where the opposite is true, but on average, it indeed

does dictate price action. When traders want to buy riskier assets they buy currencies with

higher carry, meaning AUD benefits in a risk-on atmosphere, while USD and JPY suffer. The

reverse is also true.

Thirdly, interest rates, like dividends dictate if a currency is going to perform well or not. A

higher interest rate bodes well for currency performance because a higher carry makes the

currency more desirable to traders.

What Drives the Forex Market?

Speculation/Expectation

If a market speculator thinks that one central

bank will be more aggressive in raising rates

than another central bank, the speculator will

buy the currency of the more aggressive

central bank relative to another in anticipation

of a change in the key overnight interest rate.

For example, if traders start anticipating that

the Reserve Bank of Australia will raise their

interest rates, the AUD/USD will start rallying,

as will pairs like AUD/NZD – as long as the

Reserve Bank of New Zealand is not expected

to match the rate increase.

A good gauge of expectations are the BBA

Libor (British Bankers Association, London

Interbank Offered Rate), which is an average

of interest rates outlooks by leading banks

with durations ranging from intraday to yearly

outlooks.

Another great gauge of expectations is the

Credit Suisse overnight index swaps (OIS),

which provide a percentage chance of a rate

cut by central banks. For reference purposes,

it is the difference between the LIBOR and OIS

which allows participants to measure

sentiment along with liquidity in the market

place.

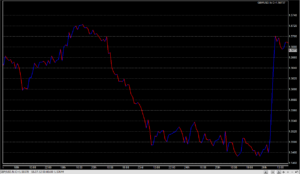

Sentiment

This is one area that is not often

talked about but very important to

understand. Investors will

completely ignore carry and interest

rates when market sentiment turns

bearish.

One thing that people carry about

more than carry trade is safety.

Some examples of fear being

injected into the market include

contagion (the spread of the

European debt crisis), natural

disasters, terrorism, or the collapse

of major banks, as was seen in 2008.

When investors become fearful, they

seek safety. Safety is found in low

yielding currencies such as the U.S.

dollar, also known as the greenback,

and these low yielding investments

become the preferred choice of

investors.

All in all, interest rate expectations are essential to understanding not only the carry trade,

but also understanding how price action is affected by speculation and/or sentiment. It is

worth noting, however that while EUR/USD is the most popular pair to trade, currencies such

as the Australian dollar are more attractive due to their interest rate appeal.