Fundamental Analysis

Fundamental analysis is the study of the strengths and weaknesses underlying the economy of a nation’s economy, and relating those findings to its currency. In very general, overbroad terms, positive economic data is good for a currency, because economic growth leads to increased interest rates, which leads to a better carry, and traders want to own high yielding currencies.

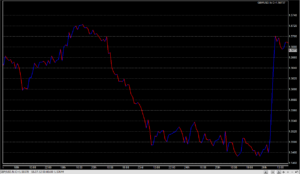

In addition to the interest rates that currently exist, traders are often focused on interest rate EXPECTATIONS – or where the interest rate will be after the next central bank meeting. These interest rate expectations are equally (or even more) important to determining the strength of a given currency as the current interest rate. These interest rate expectations are highly influenced by economic data releases. These data releases can and often do cause great market volatility, and extreme moves in price. It greatly behooves a trader to know when economic data is being released – please check out our “Key Economic Events”, available on the WrightInv.com homepage.

Do Fundamentals Really Matter?

There are a number of traders who believe that fundamental analysis is irrelevant, and that price (technical analysis) is the only relevant aspect to currency trading. Here at Wright Time Capital Group; however, we believe that both technical and fundamental analyses are essentially for a trader to have success. Certainly fundamentals alone are not enough to ensure profitability – a trader also needs a good sense of timing, and a way to determine a profitable strategy and risk / reward ratio. Fundamental analysis alone cannot do it all. Fundamentals do, however, paint a broader picture, and allow traders to maximize their capital by specifically targeting setups that take advantage of fundamental strengths and weaknesses in the underlying global economy.

5

Key Economic Events

While there are dozens of different, important economic events, this page provides you with a brief introduction into arguably the three most important – employment, inflation, and Central Bank rate decisions.

Non-Farm Payrolls and Employment Data

One of the largest economic data movers in the global financial markets, employment data, but more specifically Non-farm Payrolls serves as a guage of employment in the public and private sector along with the unemployment rate.

Consumer Price Index (Inflation)

Central Bank Decisions

One of the mostly watched central bank interest rate decision is the Federal Open Market Committee (FOMC). The focus of the FOMC are price stability and to promote employment. As the latter is necessary for economic expansion, it is also worth noting the dual mandate which combines a lower combating of consumer prices.

How does this impact the currency market? Higher yields translates into a stronger greenback relative to its counterpart, with the opposite also holding true.