Options trading is the practice of buying or selling options contracts. These contracts are agreements that give the holder the choice to buy or sell a collection of underlying securities at a set price by a specific date. Investors can, but don’t have to, own the underlying security to purchase or sell an option.

Options trading also involves two parties: the holder (buyer) and the writer (sometimes called the seller). Holders are investors who purchase contracts, while writers create them. The holder pays the writer a premium for the right to sell or buy a stock by a certain date. This premium is usually a fee per share, and it’s also the maximum a holder can lose if the contract expires worthless.

Options trading is appealing because it can allow a holder to make a bet on how a stock will perform without risking more than their initial investment. And though that might sound simple, the strategies involved in options trading can be complex. There are many other rules, risks and exceptions involved.

Success in options trading requires a strong understanding of options vocabulary, jargon and key concepts. To even get started, you’ll often need to sign an agreement and prove to your broker that you know what you’re doing.

How does options trading work?

When you trade options, you’re essentially placing a bet on if a stock will decrease, increase or remain the same in value; how much it will deviate from its current price; and in what time those changes will occur.

Based on those parameters, you can choose to enter into a contract to buy or sell a company’s stock. The most basic types of contracts are what options traders refer to as calls and puts.

After you’re locked in a contract, you can proceed in a few ways: You can exercise your right to buy or sell, you can resell your contract to another party, or you can elect for your contract to expire worthless. To recap:

Holders purchase contracts. They can exercise their right to sell or buy the underlying stock before the contract expires. If they bet on a stock’s trajectory correctly, there’s potential for unlimited gains. If the contract expires worthless, the holder will, at most, lose their initial investment.

Sellers, or writers, of contracts can make a profit off of the premiums they charge buyers. But they’re also liable for selling or buying the underlying stock at the strike price should the market move against their favor. This also means that in certain circumstances, losses can be unlimited.

Unlike stocks, options trades involve finite contract dates, which means that you don’t get the benefit of time to see if your trade will eventually move in the direction you want it to move. So options investors need to be armed with a certain level of confidence and knowledge about the stock market to make informed decisions.

Why trade options?

Typically, people trade options for three reasons: hedging, speculation or profit. Deciding whether to buy or sell — or which options trading strategy to use — largely depends on your objectives.

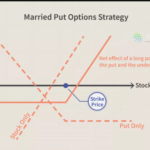

Hedging. Options can act as a “hedge” or as a sort of insurance to potentially help minimize risk from sudden changes in the market. Purchasing a protective put on a stock you own, for example, can help combat any resulting losses from that stock suddenly dropping.

Speculation. Similar to stocks, options can also be used in a speculative manner. You can place a bet on how a stock will perform over time, then purchase an options contract that reflects that view. The benefit is that you don’t have to own the underlying stock to purchase the contract and, if your bet doesn’t pan out, the maximum amount of money you’ll lose is your initial investment.

Profit. Some traders also use options for more general profit earning. That is, options can play a part in their larger investment strategies. Writers can make a profit off of the premiums they charge buyers. But they can also suffer a loss because of their obligation to fulfill the contract at the strike price.

Advantages and disadvantages of options trading

While options can arm an investor with a protective shield against loss, the nature of options trading remains inherently risky. Here are a few benefits and drawbacks to consider:

Advantages

Cheaper than stocks (sometimes). Investors can get started with options using less capital than may be required for stock trading. That’s because the premium for purchasing a contract (i.e., a bundle of stocks) can be lower than purchasing shares of a stock upfront. But options traders may also be required to maintain a margin account with a brokerage, which can drive the price of total investment up.

Low risk, high reward (sometimes). In an ideal world, option holders can magnify their wins by placing smart bets, but contracts can, and sometimes do, expire worthless. Although the loss will be limited to your initial investment, it’s still a net negative.

Insurance policy. If a holder purchases a contract that inversely reacts to a stock they own, this can help them hedge against potential losses should the underlying stock price drop. Options also allow holders to lock in a fixed price, which can feel safer than traditional investing as it gives them an out when things go sideways.

Disadvantages

Educational investment. Options trading requires a certain commitment to mastering vocabulary, jargon and options strategies to trade knowledgeably. If you’re new to investing or prefer a hands-off approach, this type of trading may feel overwhelming.

High risk for sellers and some additional costs. Writers of contracts can expose themselves to sizable risk — such as theoretically unlimited losses — when engaging in certain strategies. Meanwhile, holders may also be asked to set up margin accounts to trade, which come with additional fees, such as interest rates.

Taxes. When it comes to stocks, you can generally choose how long to hold on to an asset before selling. This allows you to be more strategic about the type of capital gains tax rate your profits will see. With options’ shorter timelines, profits you make will probably be considered short-term gains, which are taxed at a less-favorable rate. With some careful planning, though, you may be able to tap into other tax strategies, such as tax-loss harvesting, to minimize or offset your liability.